IXS DEX 1.5 is Live: Regulated Liquidity for Tokenized Assets

The IXS DEX 1.5 Upgrade is Live

The tokenization of real-world assets (RWAs) is now a $27B market, yet most remain locked without compliant secondary liquidity.

Today, we’re thrilled to announce the launch of IXS DEX 1.5, a regulated secondary trading venue under the DARE Act of The Bahamas.

The IXS DEX creates value across the entire RWA ecosystem, helping issuers unlock compliant liquidity for tokenized assets, enabling investors to trade tokenized assets securely, and driving the broader market forward.

Under the Hood: Security and Compliance Upgrades

The IXS DEX has been strengthened with cutting-edge enhancements that put security and compliance at its core:

Robust Security: Strengthened infrastructure security with tighter access controls, full key rotations, and a secure multisignature setup, further backed by integrations with leading security partners such as Hexagate, Crowdstrike, and Theos.

Enhanced KYC/AML: Every user wallet is verified, and swaps require mandatory KYC checks, but we have now raised the bar to strengthen compliance further.

“We’ve worked closely with regulators, custodians, and compliance partners to build the infrastructure institutions need to trade tokenized assets securely and compliantly,” said Julian Kwan, Co-Founder and CEO of IXS. “With the DEX 1.5 upgrade, we’re delivering a regulated trading venue that brings real-world assets into an environment built for liquidity, custody, and control."

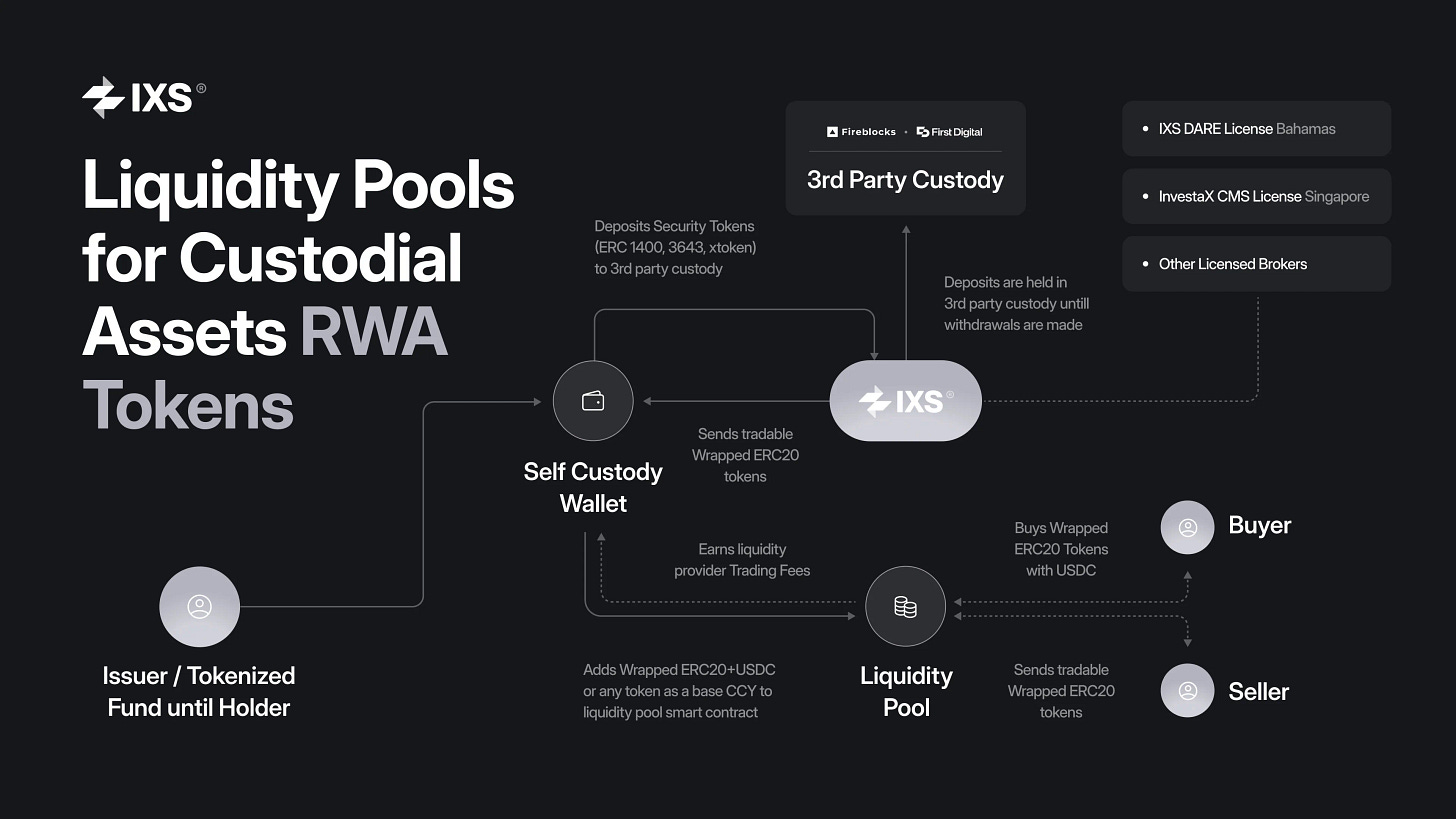

How the IXS DEX Works

We have intentionally designed the IXS DEX flow to not only allow users to trade seamlessly but also securely, by ensuring that it is aligned with regulatory frameworks. Check out the illustration below to see the flow in action.

Join Us Now

The IXS DEX is now live on the IXS platform. Read the launch article and visit the IXS App to explore and begin trading tokenized RWAs now.